Travel Cost Method (TCM)

Some amenities do not have a direct cost associated with them. For example, recreational sites may be free to enter. In order to apply a value to these types of amenities a value is often derived from a good or service which is complementary to the consumption of the free amenity. One method of estimating a value is therefore to collect data on the travel costs associated with accessing the amenity or recreational site. This is commonly referred to as the travel cost method of estimating the value of an amenity.

The travel cost method involves collecting data on the costs incurred by each individual in travelling to the recreational site or amenity. This ‘price’ paid by visitors is unique to each individual, and is calculated by summing the travel costs from each individuals original location to the amenity. By aggregating the observed travel costs associated with a number of individuals accessing the amenity a demand curve can be estimated, and as such a price can be obtained for the non-price amenity.

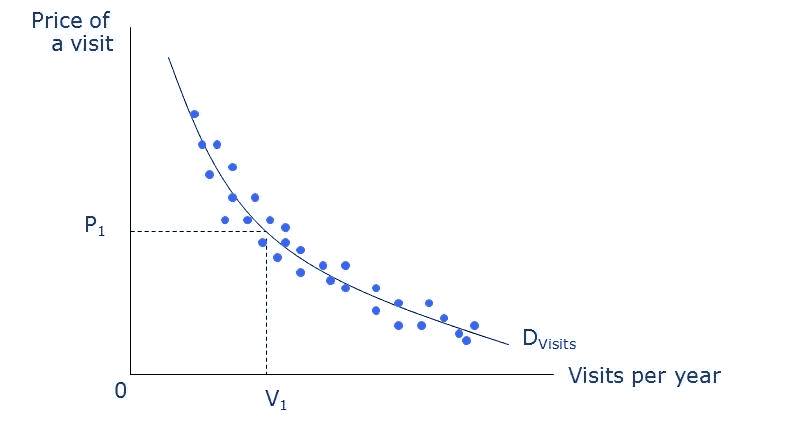

We can show this method of using observed or revealed preferences using a diagram as shown below.

D(Visits) shows the overall trend between travel costs and visit rates at a particular asset or site. To generate an estimate of the recreational value for the site, estimates are needed for the average visitors (V1) total recreational value for the site. This is then multiplied by the total number of visitors per annum giving the total annual recreational value of the site or asset. For a more complete explanation continue to the flash example.

Zonal Travel Cost Method Example

Using the zonal travel cost method a researcher can estimate the value of an asset by exploring the actual visitors or users of a site or asset, rather than potential visitors or users. The level of analysis focuses on the zones in which people live compared to the location of the asset. The researcher is required to specify the zones from which the site users travel to the asset.

Consider an example of valuing a country park. In this example four zones have been designated by the researcher. Zone A has an average travel time of 1 hour, and a distance of 25km. Zone B has an average travel time of 1.5 hours and a distance of 40km. Zone C has an average travel time of approximately 2 hours and a distance of 80km. Finally, zone D has an average travel time of 4 hours and a distance of 120km. The admission cost for all users is the same, and is equal to £10. The number of visits per year has been observed by the researcher for each zone. Zone A has an average of 10,000 visits per year. Zone B has an average of 12,000 visits per year, zone C has 8,000 visits, and zone D has 4,000 visits. This information is shown in the table below.

Zone |

Travel Time (hours) |

Travel Distance (km) |

Admission Cost (£) |

Visits Per Year |

A |

1 |

25 |

10 |

10,000 |

B |

1.5 |

40 |

10 |

12,000 |

C |

2 |

80 |

10 |

8,000 |

D |

4 |

120 |

10 |

4,000 |

To calculate the value of the asset (V) for a single visit the researcher now uses the simple equation as follows:

V = ((T x w) + (D x v) + Ca) x Va

Where,

T = travel time (in hours)

w = average wage rate (£/hour)

D = distance (in km)

v = marginal vehicle operating costs

Ca = cost of Admission to asset

Va = average number of visits per year

Using the country park example, the value of the asset can be calculated using this formula. It is important that the researcher provides an accurate measure for the average hourly wage rate, and also for the marginal vehicle operating costs. A common value for the operating costs is around £0.16p per km. This is the equivalent of around £0.40p per mile, a standard value given for vehicle operating costs in calculating expenses claims within firms and organisations.

In the example the average hourly wage rate is £10, and marginal vehicle operating costs are calculated at £0.16p per km. The researcher can now calculate the value of the country park for each zone to get an overall value for the asset. This is shown in the table below.

Zone |

Travel Time (hours) |

Travel Distance (km) |

Admission Cost (£) |

Visits Per Year |

Zone Value (£) |

A |

1 |

25 |

10 |

10,000 |

240,000 |

B |

1.5 |

40 |

10 |

12,000 |

376,800 |

C |

2 |

80 |

10 |

8,000 |

342,400 |

D |

4 |

120 |

10 |

4,000 |

276,800 |

Value of Asset |

£1,236,000 |

||||

Limitations of the TCM

There are a number of limitations associated with the travel cost method of value estimation. These are as follows:

(1) Difficulties in measuring the cost of visiting a site.

It may actually be quite difficult to measure the cost of accessing a site or amenity. This is because of the opportunity cost associated with the travel time. If the opportunity cost of all individuals is the same then the estimated price will be accurate. If, however, the opportunity cost of individuals accessing the site varies, which is more likely, then the measure will be inaccurate.

For example, one individual’s opportunity cost of the travel time spent accessing a recreational site is equivalent to one hours wage equalling £35. However, another individual’s opportunity cost for an hours wage is only £8. This is problematic to the TCM as if individual’s opportunity costs differ including the costs of time spent at the site, this would change the price faced by different individuals by different amounts.

(2) The estimation of willingness to pay used in the TCM is for entire site access rather than specific features.

As the TCM only provides a price or value relating to the cost of accessing the amenity or recreational site, it does so for the whole site. It may, however, be the case that we wish to value a certain aspect of the site in our project appraisal. For example, we do not wish to value a whole park, but instead the fishing ponds within it.

(3) The exclusion of the marginal cost of other complementary goods.

The travel cost method does not account for the costs involved in purchasing complementary goods which may be required in order to enjoy accessing the amenity. For example, individuals accessing a park area may take a football with them, or a picnic. Alternatively, individuals accessing a recreational site may take walking equipment and tents with them. The marginal costs of using this equipment should be included in the price estimated.

(4) Multi-purpose or multi-activity journeys.

Individuals may visit an amenity or recreational site in the morning, but then visit another site or enjoy some other activity in the afternoon. The travel endured to access the amenity was also undertaken to enable access to the afternoon activity. In this case the cost incurred in travelling to the amenity does not represent the value the individuals place on the amenity, but that which they place on both the amenity they visited in the morning and the one which they visited in the afternoon.

(5) Journey value.

It may be the case that the journey itself has a value to the individual. If this is true then some of the cost incurred in travelling to the amenity should not actually be applied to the individual accessing the amenity, and as such should be removed from the estimation of the amenities value.

(6) Assumed responses to changes in price.

The TCM method assumes that individuals respond to changes in price regardless of its composition. For example, TCM assumes that individuals will react consistently to a £10 increase in travel cost as they would to a £10 increase in admission costs.

- Discounting

- Discount/Compound

- Horizon Values

- Sensitivity Analysis

- Results

- NPV

- BCR

- Comparing NPV and BCR

- Downloads

- CBA Builder

- Worksheets/Exercises

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

This resource was created by Dr Dan Wheatley. The project was funded by the Economics Network and the Centre for Education in the Built Environment (CEBE) as part of the Teaching and Learning Development Projects 2010/11.

Share |